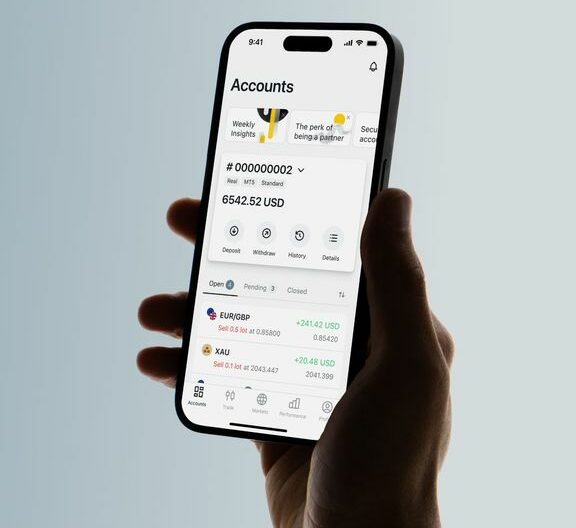

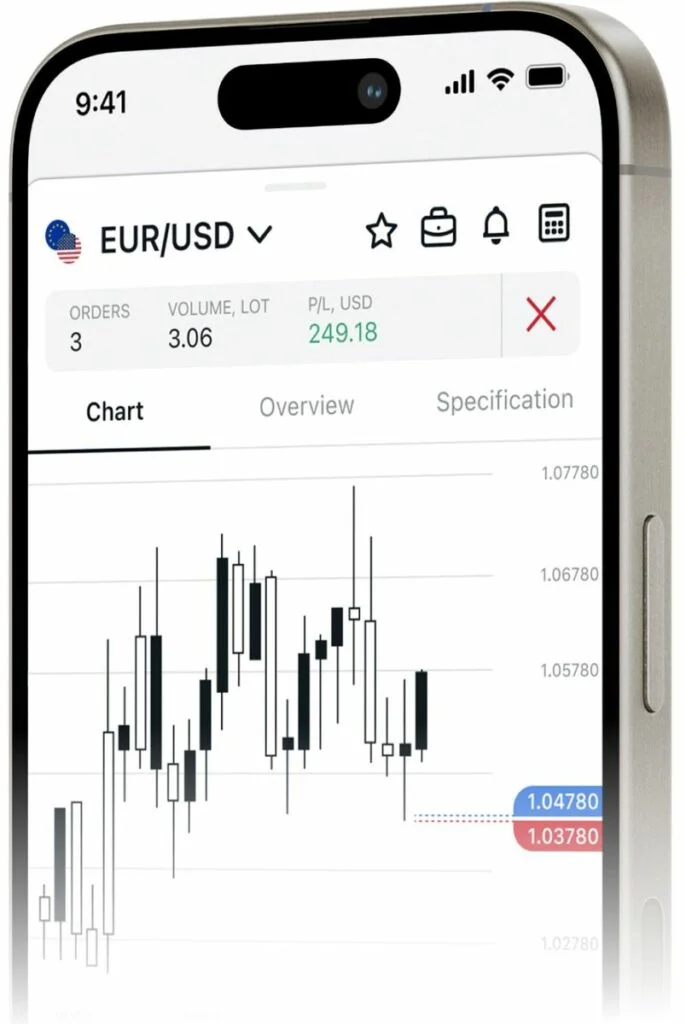

The registration process at Exness is complemented by robust security measures to safeguard user information and funds. New users are required to go through a verification process, which underscores Exness’s adherence to regulatory standards and commitment to ensuring a secure trading environment. Upon successful sign-up, traders can take advantage of Exness’s advanced trading platforms, which offer real-time market data, analytical tools, and automated trading options. Additionally, Exness provides educational resources and customer support to assist traders in maximizing their trading potential and navigating the markets effectively.

Requirements for Exness Verification in South Africa

The Exness verification process in South Africa requires traders to provide specific documents and information to comply with international and local regulatory standards. This process is critical for ensuring the security and integrity of the trading environment and for complying with anti-money laundering (AML) and knowing your customer (KYC) regulations. Here are the key requirements for Exness verification for South African traders:

- Proof of Identity (POI): South African traders need to submit a valid government-issued identification document. This can include a passport, a national ID card, or a driver’s license. The document must be current and clearly show the trader’s full name, date of birth, a clear photograph, and an identification number.

- Proof of Residence (POR): To verify their place of residence, traders must provide a recent utility bill (like water, electricity, or internet), a bank statement, or a government-issued document that shows their name and full residential address. The document should be recent, typically within the last three months, to ensure the information is current and valid.

- Document Specifications: All submitted documents must be clear and legible, with all four corners visible. They should be in a format that Exness accepts (commonly JPEG, PDF, or PNG) and must not be edited or manipulated in any way.

- Additional Information: In some cases, Exness may request additional information or documents to complete the verification process. This could include answering security questions, providing information related to trading experience, or clarifying the source of funds.

- Digital Verification: Exness may employ digital verification methods, allowing traders to complete the process online seamlessly. This might include uploading documents through the Exness platform or using a webcam for live verification.

- Compliance Checks: As part of the verification, Exness will conduct compliance checks to align with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Traders need to ensure that their provided information is accurate and truthful.

By fulfilling these requirements, South African traders can achieve verified status with Exness, enabling them to access all the features and services of the platform while ensuring a secure and compliant trading environment.

Step-by-Step Exness Verification Process

The Exness verification process is designed to be user-friendly and secure, ensuring that traders can quickly gain access to the platform’s full suite of features. For South African traders, following a structured step-by-step process will facilitate a smooth verification journey. Here’s a detailed guide to navigate the Exness verification steps:

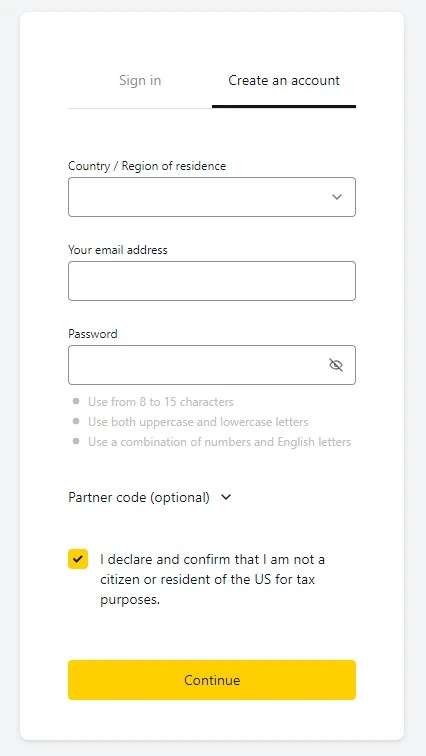

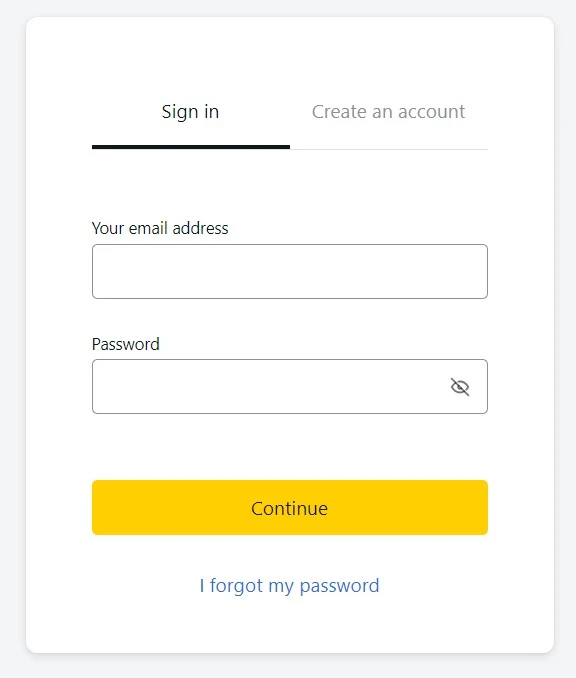

- Sign Up or Log In: Begin by creating a new account on the Exness platform or log in if you already have an account. Provide the necessary initial information such as your name, email address, and contact details.

- Access the Verification Section: Once logged in, navigate to the account settings or dashboard where you’ll find the verification section.

- Upload Proof of Identity (POI): Select the option to upload your Proof of Identity document.

- Upload Proof of Residence (POR): Choose the option to provide your Proof of Residence.

- Submit Additional Information if Required: Depending on Exness’s requirements, you may need to provide additional information or documents. Fill in any requested details accurately.

- Wait for Verification: After submitting all necessary documents and information, Exness will review your submission.

- Verification Confirmation: You will receive a notification, typically via email, confirming the status of your verification.

- Address Any Issues: If there are any issues or if further information is needed, Exness will contact you. Provide any additional information promptly to avoid delays.

By following these steps, South African traders can ensure a seamless verification process, enabling them to engage fully with the Exness trading platform. Remember, the verification is a crucial step to secure your account and comply with financial regulations, enhancing your trading experience.

Common Issues and Solutions of Exness

During the Exness verification process, traders in South Africa might encounter various common issues. Understanding these challenges and knowing the solutions can significantly streamline the verification process. Here are some common issues and their respective solutions:

Document Legibility:

- Issue: Documents submitted are not clear, or certain details are not legible.

- Solution: Ensure that all documents are scanned in high resolution or photographed clearly. All four corners of the document should be visible, and personal details must be readable. Use good lighting and avoid shadows or reflections when capturing document images.

Incorrect Document Type:

- Issue: The wrong type of document is submitted for either proof of identity or proof of residence.

- Solution: Double-check the document requirements. For proof of identity, typically, a passport, national ID, or driver’s license is required. For proof of residence, utility bills, bank statements, or government-issued documents showing your address are acceptable. Ensure the document is relevant and meets the criteria.

Outdated or Expired Documents:

- Issue: Submission of expired or old documents that do not reflect current details.

- Solution: Verify that all documents are current and valid. Your proof of residence document should be no older than three months. Ensure your ID has not expired.

Mismatched Information:

- Issue: The name or address details do not match between the provided documents or with the account information.

- Solution: Ensure that all submitted documents have consistent information that matches your Exness account details. Any discrepancies can lead to verification delays or rejections.

Technical Issues:

- Issue: Problems with uploading documents due to file size or format issues.

- Solution: Check the file size and format requirements on Exness. Typically, documents should be in JPEG, PNG, or PDF format and not exceed a certain size limit. If your file is too large, try reducing the size or converting it to an acceptable format.

Delayed Verification Process:

- Issue: Verification takes longer than expected without any updates.

- Solution: While standard verification is usually quick, delays can occur due to high demand or issues with the submitted documents. If the verification process takes unusually long, contact Exness customer support for an update or to identify if additional information is needed.

Direct Contact with Support Needed:

- Issue: Uncertainties or specific questions about the verification process.

- Solution: If any doubts or unique issues arise, it’s best to directly contact Exness’s customer support. They can provide guidance, clarify doubts, and assist with any specific requirements or challenges you might be facing.

Verification Exness Time Frame

The verification time frame for Exness accounts can vary based on factors like document clarity and volume of requests. Here’s what to expect:

- Standard Processing: Typically, Exness aims for verification within a few hours to a couple of days.

- Potential Delays: During high demand or unclear documents, verification may take longer.

- Immediate Follow-Up: Check your status if no communication within a few days.

- Expedited Verification: Clear communication can speed up the process.

- Post-Verification: Confirmation via email or dashboard grants full access.

- Proactive Approach: Ensure correct documents to avoid delays.

Benefits of Exness Account Verification

The verification process on Exness, or any trading platform, is crucial for South African traders, unlocking several benefits for their trading journey:

- Full Access to Trading Features: Verification grants complete access to all trading instruments, features, and functionalities on Exness. Unverified accounts may have restrictions on trading activities, limiting trading opportunities.

- Increased Deposit and Withdrawal Limits: Verified accounts enjoy higher limits for deposits and withdrawals, allowing for larger trading volumes and easier fund management, ideal for traders with substantial capital.

- Enhanced Account Security: Verification adds an extra layer of security, reducing the risk of unauthorized access and identity theft. Confirming your identity protects your investments and personal information.

- Regulatory Compliance: Verification ensures compliance with international and local financial regulations, including anti-money laundering (AML) and counter-terrorism financing (CTF) standards, maintaining platform integrity and reliability.

- Improved Customer Support: Verified accounts may receive more efficient customer support. With confirmed identity and account details, the support team can assist with queries or issues promptly.

- Access to Advanced Trading Tools: Some advanced trading tools are available only to verified users. These tools enhance trading strategies with in-depth analysis and better decision-making capabilities.

- Trust and Credibility: A verified account signals trustworthiness and credibility in the trading community, showing commitment to best practices and legal standards in trading.

- Participation in Promotions and Programs: Exness offers exclusive promotions, bonuses, and programs for verified users, providing additional opportunities for benefits and rewards.

- Seamless Banking Transactions: Verification leads to smoother, faster banking transactions with fewer interruptions. Banks and payment providers process transactions more efficiently for verified accounts.

Completing the Exness verification process is a strategic move for South African traders, aligning with financial security best practices and regulatory compliance, ensuring a secure and robust trading experience.

Customer Support for Exness Verification

Exness offers robust customer support to aid traders during verification, ensuring a smooth process. Here’s how Exness support can assist:

- 24/7 Availability: Access round-the-clock support, beneficial for traders in various time zones or trading at non-standard hours.

- Multiple Languages: Communicate in English or other languages, ensuring effective communication for South African traders.

- Live Chat: Utilize live chat for real-time assistance with verification queries, providing immediate help.

- Email Support: Contact support via email for detailed inquiries or document submissions, offering a thorough way to address issues.

- Phone Support: Potentially available for direct communication with representatives, useful for complex issues or preferred verbal assistance.

- Help Center and FAQs: Explore the comprehensive help center or FAQs on the Exness website for quick answers and step-by-step guidance.

- Direct Assistance: Receive targeted help for specific verification issues like document rejections or technical glitches, ensuring a smooth process.

- Verification Status Updates: Inquire about verification status and get updates on any delays or additional requirements, guiding you through the process.

Leveraging Exness customer support can greatly ease the verification process for South African traders, ensuring a seamless transition to trading activities with minimal delays.

Conclusion

The Exness verification process is essential for South African traders, ensuring compliance with regulatory standards and unlocking a range of benefits. This includes access to full trading features, higher transaction limits, and eligibility for promotions. Following the step-by-step guide and being aware of common issues can streamline verification. Exness offers 24/7 customer support for assistance, ensuring a smooth process. Completing verification empowers traders with a secure and enriched trading experience on Exness, vital for success in forex trading.

What documents are required for Exness verification?

You need a valid government-issued ID (passport, national ID card, or driver’s license) for proof of identity (POI) and a recent utility bill, bank statement, or government-issued document for proof of residence (POR).